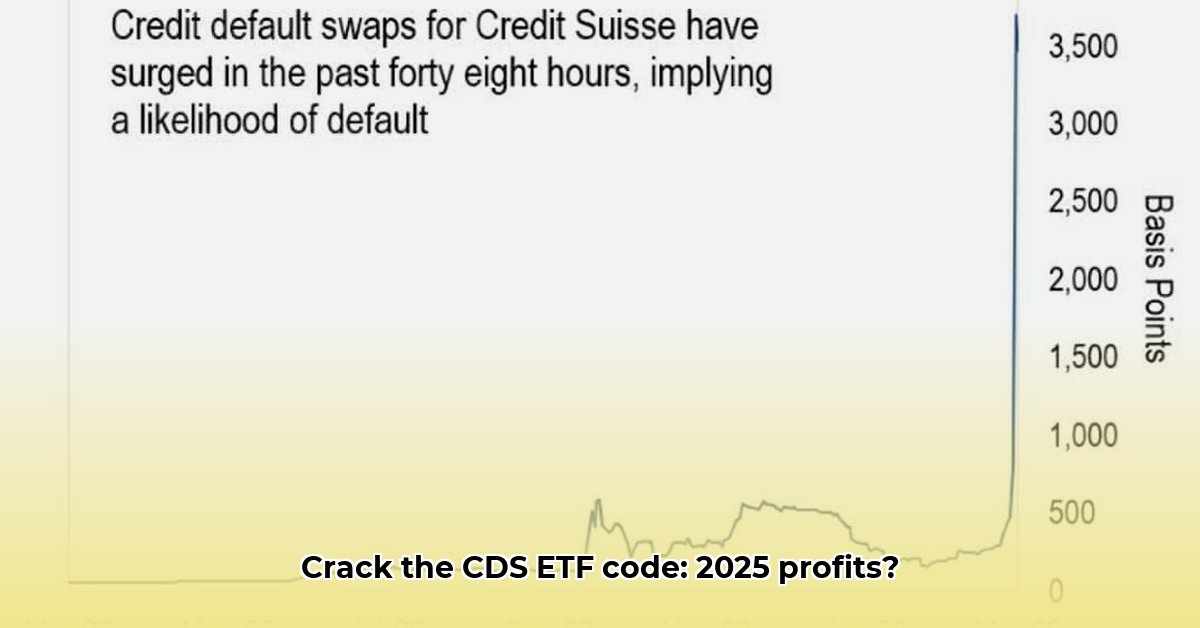

Credit Default Swaps: Understanding the Mechanics

Credit default swaps (CDSs) are complex financial instruments often described as "insurance" for bonds. They involve a contract where one party (the buyer) pays a regular fee (the spread) to another party (the seller) for protection against a default on a specific debt. If the debt issuer defaults, the seller compensates the buyer for the losses. The amount of debt covered is the notional principal. However, the seller themselves could default, creating counterparty risk – a significant concern highlighted by the 2008 financial crisis. Did you know that the interconnectedness of these contracts amplified their impact during the crisis?

Hedging vs. Speculation: Two Distinct Approaches

Institutional investors utilize CDSs for two main purposes: hedging and speculation. Hedging involves using CDSs to mitigate existing credit risk. For example, a fund holding a company's bonds might buy a CDS to protect itself from potential losses if the company defaults. This is a risk-mitigation strategy. Speculation, however, is a much riskier endeavor. It involves betting on whether a debt issuer will default. Profit is made if the prediction is correct, but losses occur otherwise. It's a high-stakes game relying heavily on market timing and anticipating shifts in sentiment. How effective is your speculative strategy in handling market volatility, considering the unpredictability of default events?

CDS ETFs: A High-Risk Investment

Credit default swaps exchange-traded funds (ETFs) provide exposure to the CDS market by bundling investments in various CDS contracts. However, these ETFs are exceptionally complex and unsuitable for retail investors due to their high risk and intricate nature. Their complexity requires significant financial expertise and risk management skills for successful navigation. These are not investments for the average investor.

The Regulatory Landscape: A Post-2008 Perspective

The 2008 financial crisis exposed systemic risks within the CDS market, prompting regulatory reforms like the Dodd-Frank Act. These aimed to enhance transparency and oversight, thus minimizing the potential for future crises. However, the regulatory environment remains intricate, with ongoing challenges and potential for further evolution. This underscores the persistent need for vigilance and adaptability in managing CDS-related risks. What measures are sufficiently robust to prevent future systemic failures related to CDSs?

2025 Risk Management Strategies: A Multi-faceted Approach

Effective CDS risk management requires a comprehensive strategy encompassing several key areas:

1. For Institutional Investors:

- Diversification: Spread investments across various issuers, sectors, and geographies.

- Rigorous Due Diligence: Thoroughly assess the creditworthiness of counterparties.

- Sophisticated Modeling: Utilize advanced models incorporating macroeconomic indicators.

- Constant Monitoring: Actively track market conditions and regulatory changes.

2. For Regulators (SEC/CFTC):

- Transparency: Demand comprehensive disclosure of CDS positions.

- Collaboration: Enhance coordination between regulatory bodies.

- Strict Enforcement: Enforce regulations firmly to ensure compliance.

- Proactive Planning: Develop contingency plans for systemic disruptions.

3. For Financial Institutions:

- Advanced Risk Models: Invest in cutting-edge models for accurate risk assessment.

- Stress Testing: Regularly test portfolio resilience against various scenarios.

- Diversify Revenue Streams: Reduce over-reliance on CDS trading.

- Harness Data Analytics: Utilize data analytics to enhance risk profiling and decision-making.

Navigating Counterparty Risk: A Critical Focus

Counterparty risk, the risk of the CDS seller defaulting, is a paramount concern. Mitigation strategies include:

- Diversification: Spread CDS purchases to reduce exposure to any one default.

- Due Diligence: Thoroughly research the creditworthiness of potential sellers.

- Collateralization: Secure contracts with collateral to act as a safety net.

- Central Clearing: Utilize Central Counterparty Clearing Houses (CCPs) as intermediaries to reduce direct counterparty risk.

Key Takeaways:

- CDSs are complex, transferring credit risk, requiring an understanding of their mechanics and inherent risks.

- Effective mitigation of counterparty risk is crucial.

- Regulatory changes, while improving stability, do not eliminate systemic risks entirely.

- The use of CDSs for hedging and speculation involves distinct levels of risk.

- CDS ETFs, due to their complexity, are generally inappropriate for retail investors.